Do markets control you or do you control the markets?

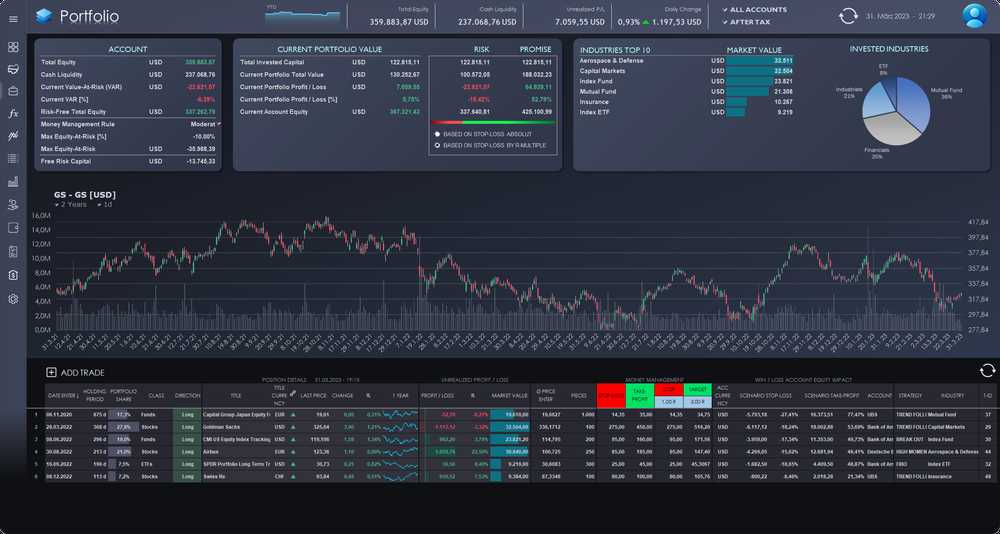

The Smart Trading Journal for Microsoft Excel gives private and professional traders full control over their trading and investment portfolios.

Search and chart prefered Symbols from within the integrated Symbolsearch and receive additional financial data.

Fast position size calculations based on trading results accompanied with the current and bootstrapped portfolios optimal f estimate.

Automatic or manual tax calculation based on individually set multi account tax groups.

Portfolio overview for all or single accounts and all asset classes together with Stop-Loss and Take-Profit management.

Determine which assets perform the best and are among the most traded ones.

Multi account view and filtering combined with withdrawal and deposit charting.

It is essential for every trader to monitor their market performance. No matter if you are trading stocks, ETFs, options, bonds, futures, FOREX or all together – the Smart Trading Journal will keep track of all your trades and portfolios.

Import/Export all transactions and trades from/to another Excel Workbook.

Multi currencies support for advanced exchange rate calculations and account setups.

Stocks, Futures, CFDs, Options, FOREX, ETFs, Commodities, Funds, Warrants, Option Warrants and Bonds

The strategy selector shows up to 10 user defined strategies in comparison and aggregation.

Protect the journal from unauthorized access.

Easily switch between dark and light mode.

Supported languages are English, French, German, Italian and Spanish.

Automatic refresh of all quotes every 15 minutes upon selection.

The flexible and user defined scoring system will help to improve ones trading.

One click on the user picture will take a seamless screenshot from within excel.

Import an individual userpicture to personalize the journal.

Manual sorting of result columns is supported upon double-clicks.

Switch between calculations with or without tax and fess included.

Attachment of saved trade pictures for review and analysis.

The intention of the Smart Trading Journal is to model all trading activities and account transactions of daytraders, institutional traders, private traders and/or everyone who is participating in short to longterm financial investments alike. Its comprehensive statistical calculations give valueable insights and performance measures every serious trader should know about. The individual trading results are hence part of the optimal portfolio and position size calculations which can be of great significance in a traders investment plans. The concept of R-multiples which has been introduced by Van Tharps “Definitive Guide To Position Sizing”, is the foundation to many calculations as well as the risk and objective simulation in particular. Apart from that it is advisable for every trader to become familiar with statistical trading principles in general.

The available scoring and commenting features will help to develop a personal trading style and improve on every trade taken.

Finally the Smart trading Journal is meant to be the one tool where all investment activities are documented and tracked without being dependent of a specific brokers or banks API.

No. Market data is aggregated from free online market data providers. Some quotes are realtime whereas others are delayed by 15-20 minutes.

Because data is taken from free online resources, it might be possible that market data won’t be continued in the future. This is not under control of the Smart Trading Journal. Due to the fact that used data providers are serious and well known a discontinuation of past and present market quotes is not to be expected in the near future though.

Probably not. As you will enter each trade and transaction by hand, the exported trades list of the Smart Trading Journal can not replace your official bank statement. It might be of interest for your personal and/or tax consultants information though.

Tax calculations in general are dependent to each jurisdiction or tax regulation the customer is bound to. Therefor it might not be possible to include every detail in the calculations of your personal tax. The categorization of different tax groups for your trading accounts will enable varying taxation setups though. It is possible to input divers settings to accounts for complex scenarios such as different yearly compensation mechanisms for stock and forward deals or tax exemption limits. So far general tax calculations, e.g. tax pools compensation, are based on the current german tax regulations.

If your automatic tax calculation is incorrect, there is always the possibility to enter a manual tax value for every trade, dividend and interest payment which will take precedence over the automatic calculated tax values. The tax pools will not be affected of a manual tax value though.

Setup of the Smart Trading Journal is easily done. Just extract the Excel workbook and the accompanying .xll library file from the zip file to a desired folder of choice. Upon first usage the journal will ask for the necessary .xll library file which the user must select (x64 for 64bit and x86 for 32bit Version of MS Excel). The plugin will then be activated and copied to the default office add-ins location path. The prior extracted .xll file may be removed afterwards. There are no restrictions as to where the Smart Trading Journal has to be saved to as long as the add-in is installed properly. If the demo add-in is still active, it will be deactivated and removed automatically (if still present though, it should be removed manually).

Uninstalling the Journal is as easy as removing the .xll file from the default MS Excel add-ins location path and deleting the journal file itself.

Update checks may be executed automatically or by user interaction within the license and setup information panel.

If an update for the users licensed version is available, the user is asked to download the new zip archive including the updated Smart Trading Journal. If a new .xll file is present within the zip archive, the current add-in needs to be replaced with the new one. The easiest way to accomplish this task is to deactivate the current SmartTradingJournal add-in within the add-ins managment of MS Excel and to remove the add-in file from the default MS Excel add-ins location path (there are lots of instructions online on how to remove add-ins in MS Excel). When opening the updated journal file for the first time the user will be asked to select the add-in once more. Make sure to transfer the prior journal settings and use the export/import functionality to import all transactions to the updated Smart Trading Journal.

Upon first usage you will be asked to provide your registration name and email address together with the personal activation code which you received after purchase. In case you did not buy the lifetime Pro version, the activation code will loose validation after the subscription period. The current details are visible from within the setup and license panel.

No. There is no possibility to connect to a brokers API and use the Smart Trading Journal for online trading.

All trades, dividends and interest payments or other account transactions have to be entered manually from within the journal.

All calculations have been developed with great care, but are quite complex in nature. Neverthless, if you think results are not correct or there is an error within the calculations, please contact the support at moc.lanruoj-gnidart-trams@tcatnoc to remedy such issues as soon as possible.

The user must specify and keep a clearing currency within the user settings which will define the journals base calculation currency. This might be the currency which the users home jurisdiction is subsidiary, but can be any other as well.

Transactions in other currencies need a declaration of a currency conversion rate. If the accounts currency will differ from the clearing currency it might even be necessary to specify a second conversion rate in addition. This is done within the input fields of the transaction form and will be mandatory. The required conversion rate will be indicated as well. Currency conversions will be considered in caclulations and price quote updates.

Yes. Every transaction will be assigned a transaction ID (T-ID). Therefor it is possible to build up and decrease existing orders in size. Every partial order must be created with an original order T-ID. Upon transaction creation there will be a T-ID selection field in the upper right hand side corner of the input form which will list entitled existing orders for adding partial orders to.

Symbol names can sometimes be very cryptic and the user can’t know them by heart. Therefor a symbol search option is available weherever the symbol has to be specified. The symbol search will inform the user of other information, such as industry and symbol class, as well.

The idea is based on Van Tharps trading principles of R(isk)-Multiples and expectations as a measure of statistical revenue.

The user may input multiple varying R-Multiple values eventually combined with an expected standard deviation and provide desired simulation properties such as amount of trades per single simulation and amount of simulations in total. The definition of R-Multiple values is combined with a probability of incidence between 0-100% in summation.

E.g. 10% of trade returns are expected to result in a profit of 10R, 20% in a profit of 2R and 70% in a loss of -1R. The simulation will use this information and calculate a normal distribution based probability of objective and drawdown attainment as well as an average and median trade series profit in relation to total equity based position risk per trade.

The objective probability will specify to which percentage the users defined level of desired objective with the specified number of trades per simulation will be achievable. On the other hand the drawdown attainment is a measure to how realistic a drawdown of specified amount is to be expected. An optimal trade position size will try to maximize the probability to reach the objective and minimize the chance on hitting the drawdown.

In addition the calculation will determine the expectation value of the R-Multiples probability distribution the user declared.

Upgrades are charged as much as the difference of the upgraded subscription to the one that has already been purchased. So there are no additional costs if you decide to upgrade later on. Just use the links below the ‘Buy Now’ buttons for a separate upgrade if desired. The original license code that is going to be upgraded must be specified during checkout. The new license details can be entered in the license information panel within the journal itself.

Not really. In regard to the features of the purchased license the only additional restriction is that the journal shall not be used on more than 10 different PCs, i.e. on different hardware. Transfering the journal to different hardware is not a problem as far as the journal will need manual reactivation. There is always the option to export the transactions list to a new spreadsheet as well. An active internet connection is not necessary for normal operation (besides the intention to query price quotes and updates of course).

Because the Smart Trading Journal is a digital good delivered via Internet download refunds are generally not offered. Nevertheless if the customer changes mind about a purchase and did not download the Smart Trading Journal, a full refund will be granted upon request within 14 days after purchase.

Please use the free trial version to extensively test and experience the Smart Trading Journal before deciding to purchase the journal itself.

More information on returns and refunds here.

The free trial version comes with certain restrictions:

Zip-Size: 7.57MB

SHA256:

6CDFFB2D 108A79EC 0817FE65 943EC319

DF1B41D4 7FF71B1D FDF23F56 BD0B9453